ETH Price Prediction: Path to $5,000 Amid Technical Strength and Market Divergence

#ETH

- Technical Foundation: ETH trading above 20-day MA provides bullish support with Bollinger Bands indicating room for upward movement toward $4,712 resistance

- Market Sentiment Divergence: Strong holder accumulation conflicts with trader shorting activity, creating potential for volatility but also underlying strength

- Path to $5,000: Requires breaking key resistance levels and sustaining momentum despite negative MACD signals, representing a 15.2% move from current levels

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

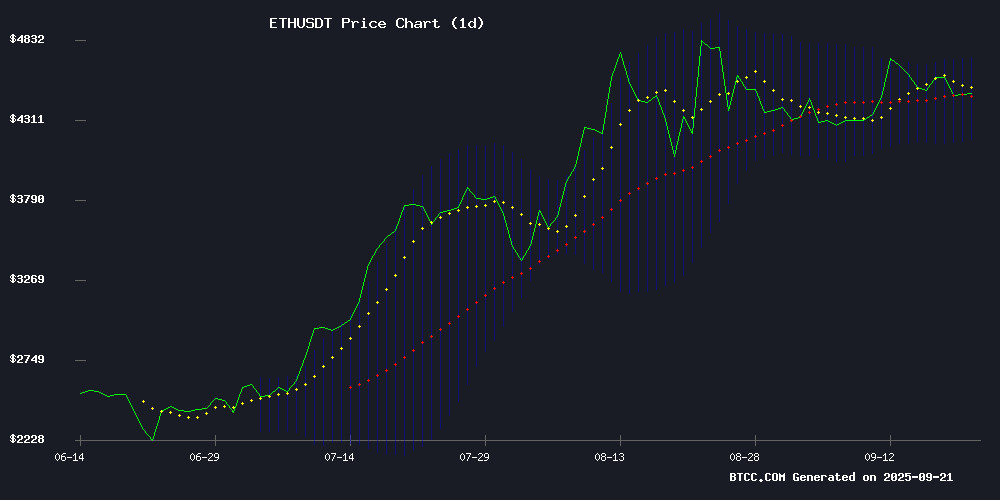

Ethereum is currently trading at $4,454.56, slightly above its 20-day moving average of $4,448.79, indicating potential upward momentum. According to BTCC financial analyst James, 'The price holding above the 20-day MA suggests underlying strength despite the negative MACD reading of -85.52. The Bollinger Bands show ETH trading within a normal range between $4,184.71 and $4,712.88, with the middle band providing crucial support.'

Market Sentiment: Diverging Views Amid Strong Accumulation Patterns

Current market sentiment presents a mixed picture for Ethereum. While strong accumulation by holders is supporting the $4,500 level, traders are taking short positions despite significant stablecoin inflows. BTCC financial analyst James notes, 'The divergence between holder accumulation and trader shorting activity creates an interesting tension. The bullish sentiment building gradually suggests underlying confidence in ETH's medium-term prospects, though short-term volatility may persist.'

Factors Influencing ETH's Price

Ethereum Holders Prop Up Price at $4,500 Amid Strong Accumulation

Ethereum demonstrates resilience as holders accelerate accumulation, withdrawing over 420,000 ETH ($1.87 billion) from exchanges in a week. The altcoin king now flirts with the $4,500 resistance level, trading at $4,468 despite mixed broader market conditions.

Technical indicators reinforce bullish sentiment, with the RSI holding firmly above 50 throughout May. This sustained momentum suggests institutional confidence remains unshaken by recent volatility. Market participants appear to be positioning for a potential breakout, with exchange outflows signaling reduced sell pressure.

Ethereum Faces Divergent Signals as Traders Short Amid Strong Stablecoin Inflows

Ethereum markets exhibit conflicting signals as bearish derivatives positioning clashes with substantial stablecoin inflows. Binance traders have driven the ETH taker buy/sell ratio below 0.87 - a level only seen twice previously in 2024, both instances preceding sharp corrections. The ratio's 7-day average sits at 0.93, marking the year's most extreme bearish sentiment.

Countering this pessimism, $1.6 billion in stablecoins flooded ETH markets within 24 hours, revealing latent buying pressure. Such liquidity injections historically precede volatile movements, creating conditions ripe for either a short squeeze or corrective drop. Analyst TedPillows observes ETH consolidating NEAR its 2021 all-time high, a technical pattern that typically resolves through explosive breakouts or reversals.

Ethereum Price Analysis: Bullish Sentiment Gradually Builds for ETH

Ethereum maintains a bullish stance above the $4K psychological level, consolidating within a steep ascending channel. Higher highs and higher lows characterize its daily chart, with the 100-day and 200-day moving averages reinforcing the uptrend. Neutral RSI at 51 leaves room for upward momentum if buyers reclaim control.

The $4.8K resistance remains pivotal—a breakout could propel ETH toward $5K, while a channel breach may trigger a retest of $4K or $3.5K support. On shorter timeframes, ETH oscillates between $4.3K and $4.8K, with consistent dip-buying activity signaling persistent demand.

Will ETH Price Hit 5000?

Based on current technical indicators and market sentiment, ETH reaching $5,000 appears achievable but requires specific conditions. The price holding above the 20-day moving average at $4,448.79 provides a solid foundation for upward movement. However, the negative MACD reading suggests some near-term caution is warranted.

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $4,454.56 | Above 20-day MA support |

| Bollinger Upper | $4,712.88 | Initial resistance target |

| Psychological Target | $5,000.00 | 15.2% upside required |

| 20-day MA Support | $4,448.79 | Critical support level |

BTCC financial analyst James suggests that 'While $5,000 is within reach, ETH needs to break through the Bollinger upper band at $4,712 and maintain momentum amid the current mixed sentiment between holders and traders.'